$130 million donation by Timothy Mellon highlights significant fiscal strain for U.S. military personnel in 2025. Over 1.3 million active-duty troops face uncertainty due to federal budget impasses, a critical concern for national defense spending as of October 25, 2025.

This event underscores the impact of government shutdowns on military compensation and the limitations of private funding for systemic gaps. Market analysts are closely monitoring broader economic implications for defense stocks.

Key metrics for defense stocks remain under scrutiny as the Trump administration’s 2025 budget requested $600 billion for military pay.

This analysis delves into the fiscal strain and its market implications.

Expert Market Analysis

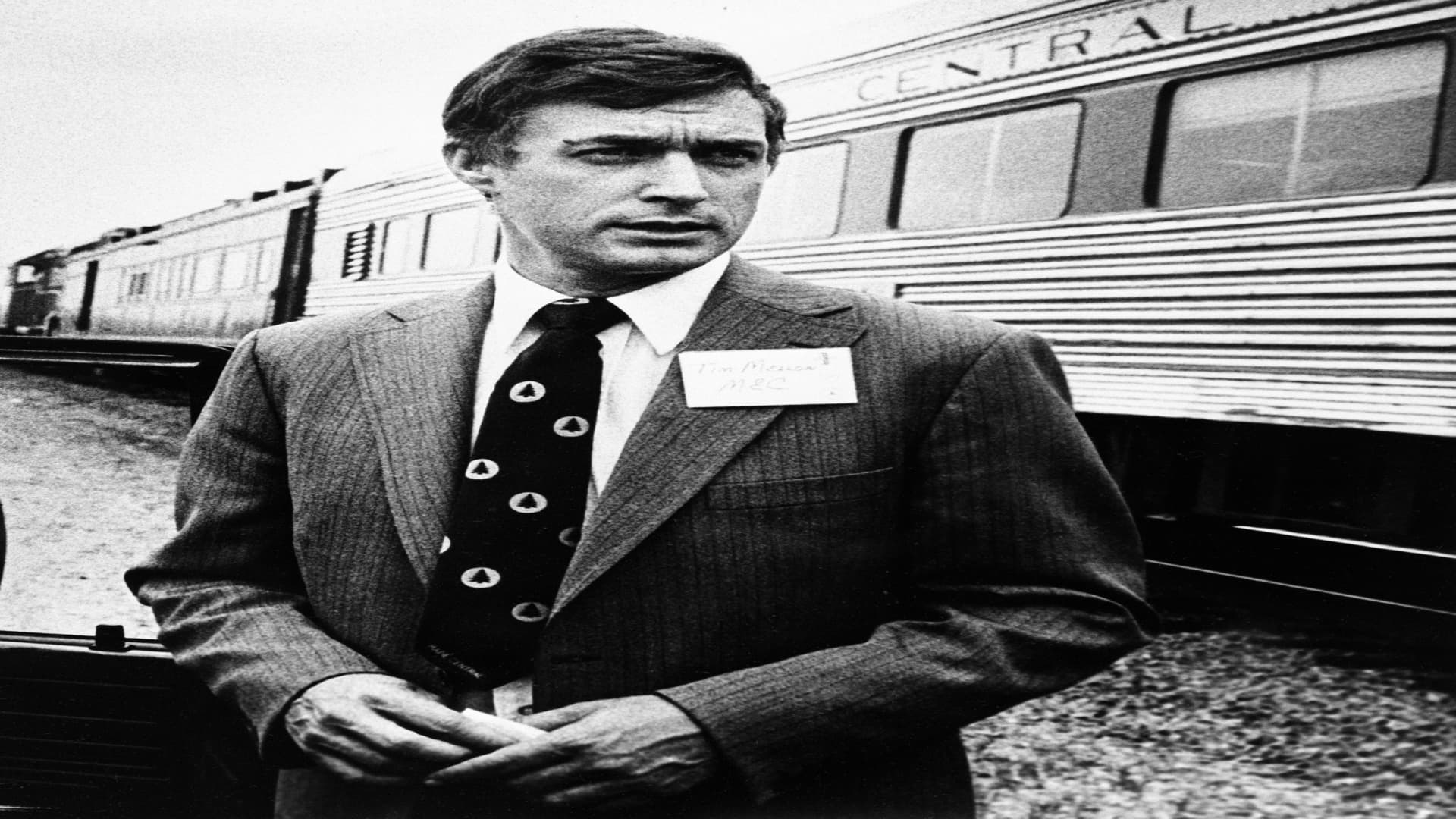

The substantial $130 million donation by Timothy Mellon to U.S. military personnel during the 2025 government shutdown represents a significant, albeit symbolic, response to fiscal pressures. Historically, military compensation has been a non-negotiable component of federal government spending, directly appropriated by Congress. However, prolonged shutdowns, such as those observed in late 2025, inject considerable economic anxiety and operational challenges into the armed forces. While Mellon’s donation is generous, its per-service-member distribution highlights that it cannot offer a sustainable solution to systemic funding deficits, acting more as temporary relief. The broader economic landscape of 2025 is characterized by volatility, making such private financial infusions a focal point for discussions on the reliability of governmental funding mechanisms for essential public services, including national defense. This situation raises profound questions about the continuity of government funding for critical sectors.

From a financial and legal perspective, this donation raises critical questions regarding its potential conflict with the Antideficiency Act, which strictly prohibits federal agencies from obligating funds beyond their allocated congressional appropriations. Reports, including those from The New York Times, suggest that regulatory bodies are scrutinizing the practical implementation and acceptance of such private funds by federal entities, despite the evident charitable intent. For investors, the underlying cause—the government shutdown—poses inherent risks associated with fiscal impasses, which can disrupt economic activity and introduce uncertainty into government-dependent sectors. While Mellon’s donation itself may not directly affect specific publicly traded companies, the broader implications of a shutdown can create ripple effects across defense contractors and other industries reliant on government contracts and spending. Investors should meticulously monitor the duration of the shutdown and legislative resolutions for a clearer market outlook, paying close attention to company cash flow statements and order backlogs.

Comparing this to other instances of private funding for public services reveals a stark divergence; direct support for military personnel salaries by private citizens is largely unprecedented. Typically, private foundations and corporate social responsibility initiatives focus on areas like disaster relief or infrastructure development, whereas direct military pay is considered a core governmental responsibility. Major defense industry players such as Lockheed Martin (LMT), Raytheon Technologies (RTX), and General Dynamics (GD) are intrinsically linked to consistent government appropriations. A prolonged shutdown could result in project delays, deferred payments, and a tangible impact on their revenue streams. Although Mellon’s donation targets personnel salaries, the broader shutdown affects overall defense spending, procurement, and research and development investments. Historically, markets have demonstrated resilience to short-term shutdowns, but extended periods can lead to significant corrections and heightened investor caution, potentially impacting the stock performance of these defense giants. Current market sentiment leans towards a cautious approach towards defense stocks amid such prevailing uncertainties.

The expert takeaway from this unusual event is clear: while Timothy Mellon’s generosity is commendable, it critically exposes systemic issues within government budgeting and the profound reliance on congressional action for essential public services. Retail investors should perceive this as a potent reminder of potential volatility stemming from political gridlock, rather than a new investment avenue in the defense sector directly tied to private donations. Institutional investors may consider re-evaluating their exposure to government-dependent industries during periods of heightened political uncertainty. The primary risk factor remains the shutdown’s duration and its eventual resolution. Key events to monitor include ongoing congressional negotiations and official statements concerning the donation’s legal standing and its long-term implications for federal funding practices, all of which will significantly shape the outlook for defense budgets.

Related Topics:

Military Funding 2025, US Military Aid, Government Shutdown Defense, Timothy Mellon Donation, Defense Stock Analysis, Antideficiency Act, Military Salaries Uncertainty, Fiscal Strain Outlook, Lockheed Martin Stock, Raytheon Technologies Outlook