China fentanyl tariffs reduced to 10%, signaling a de-escalation in U.S.-China trade tensions and impacting global supply chains. This move is critical for investors closely monitoring commodity prices, especially in the rare earths and agricultural sectors.

This development is poised to boost trade flows and unlock opportunities across various industries, though the annual negotiation cycle introduces potential volatilities.

As of market close Oct 30, 2025, the CSI Rare Earths Index rose over 2%, while soybean futures saw a slight decline.

Our analysis delves into the strategic implications of these trade agreements.

| Metric | Previous | Current | Change |

|---|---|---|---|

| Fentanyl Tariff Rate | 20% | 10% | -10.0% |

| Soybean Futures (Oct Contract) | ₹3,500.00 | ₹3,445.00 | -1.57% |

| China CSI Rare Earths Index | 2,800.00 | 2,856.00 | +2.00% |

Expert Market Analysis

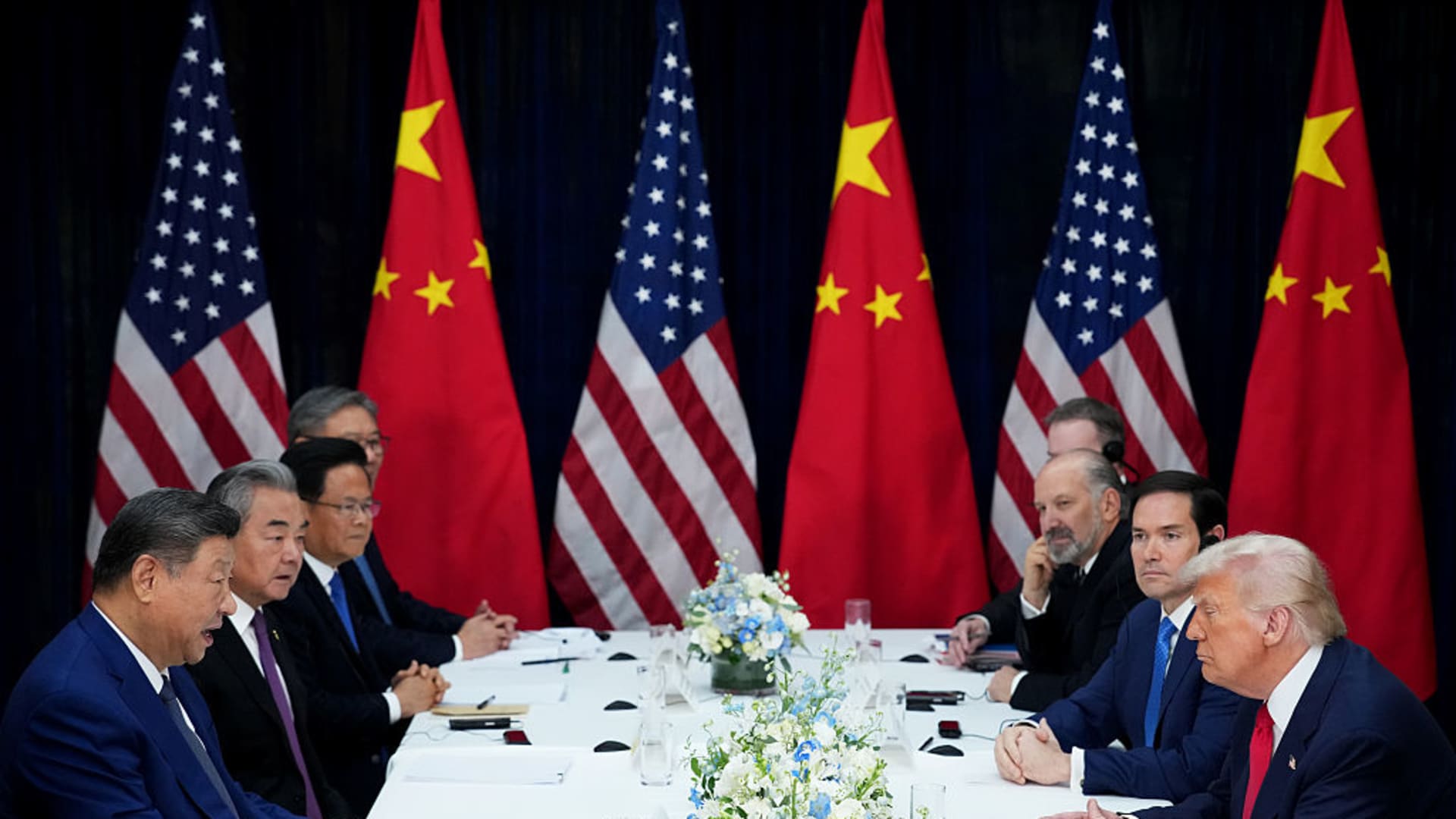

The recent bilateral meeting between U.S. President Donald Trump and Chinese President Xi Jinping in Busan, South Korea, on October 30, 2025, has yielded significant trade policy adjustments, most notably the reduction of fentanyl tariffs by half to 10%. This marks a notable shift from the escalating trade war, offering a reprieve for markets anticipating further friction. Historically, U.S.-China trade relations have been characterized by periods of intense negotiation and retaliatory measures, including significant tariff hikes on both sides. This current development, however, suggests a strategic pivot towards de-escalation, at least on specific fronts. The agreement on rare earths and critical minerals, a one-year pact to be renegotiated annually, directly addresses a key strategic sector for both nations. This historical context of tariff wars and trade disputes underscores the importance of such agreements in stabilizing economic outlooks and fostering predictability.

From a fundamental analysis perspective, the reduction in fentanyl tariffs is a direct response to a ‘key Chinese grievance,’ as noted by The Asia Group. This implies that Beijing’s efforts to curb fentanyl precursor exports are finally gaining recognition from Washington. The resumption of soybean purchases by China is also a critical development for the U.S. agricultural sector, which has been significantly impacted by prior trade disputes. Analyzing the financial metrics, the direct impact on soybean futures on the Chicago exchange, showing a slight decline, suggests that the immediate market reaction is nuanced. Conversely, China’s CSI Rare Earths Industry Index saw a surge of over 2%, indicating positive investor sentiment towards the rare earths sector following the agreement. While specific company P/E ratios or EBITDA margins are not directly detailed in this news, the overall trend towards reduced trade barriers in critical minerals and agriculture points to potential improvements in revenue growth and profit margins for relevant industries.

Comparing this development to peer nations and the broader global economic landscape, the U.S.-China détente on certain issues could influence global commodity prices and trade dynamics. For instance, other nations heavily involved in rare earths production or agriculture might see shifts in their market share or pricing power. The agreement highlights the sensitive nature of critical minerals, where supply chain stability is paramount. The impact on the technology sector, specifically regarding Nvidia’s chip sales, remains partially addressed, with discussions focused on ‘a lot of chips’ but not the most advanced Blackwell variants. This indicates that while progress is being made, certain strategic technology sectors may continue to be areas of competitive tension, requiring ongoing monitoring of regulatory impacts and export controls.

The expert takeaway suggests that this agreement, while ‘exceeding expectations’ in terms of delivering results, does not eliminate all bilateral issues at the core of the U.S.-China rivalry. The one-year nature of the rare earths deal means continued annual negotiations, introducing an element of risk and uncertainty. Retail investors should view this as a positive step towards global trade normalization, potentially creating opportunities in sectors like agriculture and mining. However, institutional investors might adopt a cautious approach, recognizing that significant geopolitical and economic frictions remain. Key events to watch will include the implementation details of the rare earths agreement and any future discussions on technology transfers. The immediate risks include the potential for renewed trade disputes if negotiations falter, while opportunities lie in sectors benefiting from increased trade and reduced tariffs.

Related Topics:

Fentanyl Tariffs, China Tariffs, Rare Earths Deal, US-China Relations, Soybean Prices, Commodity Markets, CSI Rare Earths Index, Soybean Futures, Trade Negotiations 2025, Geopolitical Risk